what credit score is used to buy a house

The minimum credit score most VA lenders require is. Several factors are evaluated to determine your credit score and conventional and government-backed loans have different credit score requirements.

Credit Score Ranges And What They Mean For Your Money Credit Score Range Credit Score Bad Credit Repair

With that said its still possible to get a loan with a lower credit score including a score in the 500s.

. At the start it will determine which loan options you can even consider as a homebuyer. If your score is high. Weve shown these ranges below. Your file will include previous credit cards loans mortgages overdrafts and even some utility and phone bills.

Mortgage lenders also look at your employment history how much debt you have. Most scoring models use a range of 300 to 850 and theres a correlation between the number and my perceived reliability. Theres a baseline rate and you dont get rewarded for a great credit score with a lower rate. And there is more good newsmortgage rates in general are not tied to your credit score.

Other services may also offer scores for purchase. Your credit score is something that lenders will use to help them decide whether or not you qualify for a particular product such as a mortgage or credit card. Lenders use their own credit requirements. The minimum credit score needed to buy a house depends on the mortgage program and the lender.

Applicant 1 has three scores of 725 715 and 699. Credit scores range from 300 to 850 and are often crucial to the homebuying process. According to mortgage company Fannie Mae a conventional loan usually requires a credit score of at least 620. You dont get penalized eitheryour.

Read on to learn more about credit scores and how they impact the homebuying process. So what credit score do you need to buy a house then. Your payment history current debt levels types of credit accounts and the average age of your credit accounts all affect your credit score. If your score is below that you might want to talk to a mortgage.

In this case youll want to look at ways to clear your credit record. You can buy a score directly from the credit reporting companies. Your FICO score determines which type of mortgage loan youre eligible for or whether you qualify at all. Theres no magic number but all credit scores sit within a range such as excellent or fair.

Heres the good newsyou can actually qualify for a mortgage loan with a credit score as low as 500. What credit score do you need to buy a house. But you may qualify for a government-sponsored loan with a lower score. While the FICO 8 model is the most widely used scoring model for general lending decisions banks use the following FICO scores when you apply for a mortgage.

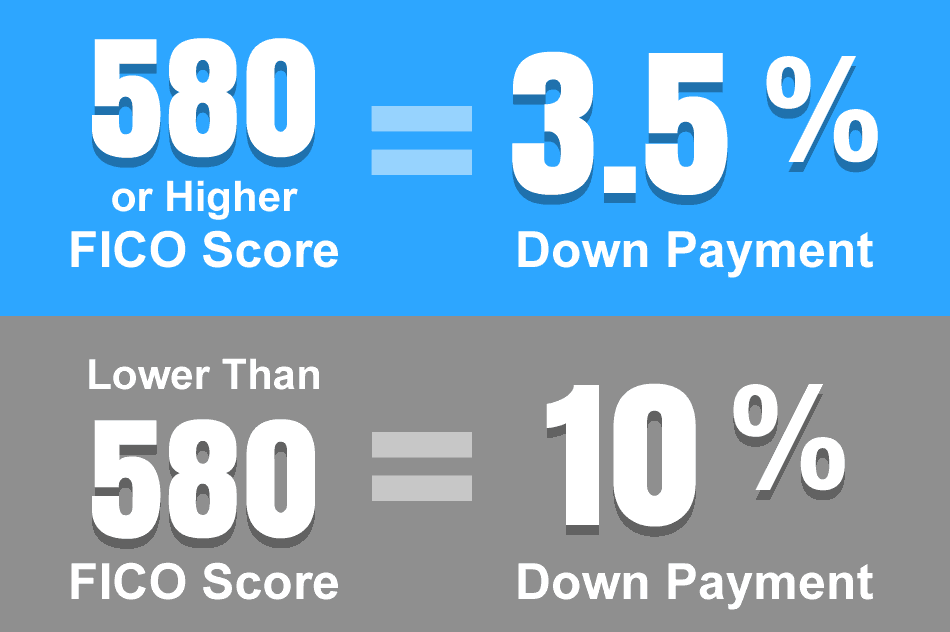

It is important as it will determine what financial products you can take out and how much interest you will pay. A 10 down payment is required for borrowers with at least a 500 score. You need a580 credit score to buy a house using an FHA loan. A good credit score is from 700 to 749.

If youre planning to buy a home your credit score will play a big part in the process. According to Equifax one of the three major credit bureaus 580 to 669 is a fair score. Lenders use credit scores to determine a borrowers level of risk. Your FICO score determines which type of mortgage loan youre eligible for or whether you qualify at all.

Each applicant has three scoresone from each major credit bureauand the lender looks at the middle score for each. Borrowers usually need a down payment of 10 or more and a credit score of at least 680 for a loan of 15 million or less the minimum median credit score is. You dont need to have perfect credit to get a mortgage. Thats the minimum credit score requirement most lenders have for a conventional loan.

While some loan types require minimum scores as high as 640 conventional loans others go down to 500 some FHA loans. Whats A Good Credit Score To Buy A House. If your credit score isnt anywhere near 900 take heart. A credit score is a number between about 300 and 850 that conveys to lenders how risky you are as a borrower.

How Your Credit Score Impacts Your Mortgage Prospects. From 670 to 739 is good while 740 to 799 is very good and over 800 is excellent. Before you apply for a mortgage its a good idea to check your credit score and review your credit. A fair credit score 650 to 699.

However those who have a good credit score of 740 and higher will be offered the best mortgage rates. Credit Score Needed To Buy A House By Loan Type Your credit score is a number that ranges from 300 850 and that is used to indicate your creditworthiness. Buy a score comes with a fee. The higher your credit score the better interest rate youre likely to get which also means youll have a lower monthly mortgage payment.

The average credit score for buying a home is 680-739. Applicant 2 has three scores of 688 652 and 644. Its important to check your credit score to know where you stand. Credit score in 2020 was 710.

If you decide to purchase a credit score you are not required to purchase credit protection identity theft monitoring or other services that may be offered at the same time. If your credit rating is fair you should also be eligible for a mortgage. The Department of Veterans Affairs does not do not have a minimum credit score requirement to guarantee a loan. For an average loan amount of 253435 the average mortgage borrower with a very good credit score paid about 219660 in interest over time while the fair score borrowers paid 261076.

In fact as long as your credit score is in the 600-700 range it should satisfy the credit requirements for your mortgage application with one of Canadas main financial institutions. A credit score lower than 650 is deemed poor meaning your credit history has had some rough patches. In Canada credit scores range from 300 to 900. Generally speaking youll need a credit score of at least 620 in order to secure a loan to buy a house.

Youre much more likely to be approved for a mortgage if you have a credit score that is good or excellent. A LendingTree study showed that borrowers with a fair score 580-669 pay significantly more in interest than those in the very good range 740-799. However your credit score alone doesnt determine whether youll be approved. Veterans of the military are eligible for VA loans.

Three credit bureaus Equifax Experian and TransUnion calculate an individuals credit score. Scores below 600 would be considered high to very high risk. FICO Score 2 Experian FICO. A score of 670 is considered an excellent credit score significantly boosting your chances of home loan approval.

What Is The Minimum Credit Score Needed To Buy A House And Get A Kentucky Mortgage Loan Mortgage Loans Credit Score Buying Your First Home

Minimum Credit Scores For Fha Loans

Knowing What Is A Good Credit Score To Buy A House Good Credit Score Good Credit Credit Score

What Credit Score Do You Need To Buy A House In 2021 Credit Score Home Buying Best Interest Rates

Find Your Credit Score Find Your Credit Score Find Your Credit Score Find Your Credit Score Anyone Who X27 S Ever Credit Score Credit Karma Good Credit

What Credit Scores Consist Of For A Kentucky Mortgage Loan Approval For A Fha V Mortgage Loans Pay Off Mortgage Early Mortgage Payoff

Ah The Dreaded Credit Score It S One Of The Biggest Criteria Considered By Lenders In The Mortgage Application Proces Credit Score Scores Home Buying Process

Fico Score 8 And Why There Are Multiple Versions Of Fico Scores Myfico Myfico Fico Score Credit Education Credit Score

Posting Komentar untuk "what credit score is used to buy a house"